Sir Jim Ratcliffe is to commit $300m (£245m) from his multibillion pound fortune to Manchester United Football Club’s ageing infrastructure as part of a deal to acquire a 25% stake that will be unveiled this month.

Sky News can exclusively reveal that Sir Jim, founder of the Ineos petrochemicals empire, will pledge the investment alongside the acquisition of a shareholding likely to be worth more than £1.25bn.

Sources said on Friday that the £245m investment would be staggered, with the bulk of it being handed to the club by the end of the year.

They added that it would be financed by Sir Jim personally and would not add to Manchester United’s existing borrowings.

Sir Jim’s purchase of a 25% stake in the Red Devils – first revealed by Sky News last month – will come almost exactly a year after the Glazer family, which has controlled the club since 2005, began formally exploring a sale.

Adding together the cost of the stock purchase and the other capital for investment means that Sir Jim will be committing about £1.5bn on day one of his United interest, although that figure could vary depending on the price he ultimately pays for the shares.

After months of negotiations with several potential buyers, including the Qatari businessman Sheikh Jassim bin Hamad al-Thani, the British billionaire’s acquisition of a minority stake has emerged as the Glazers’ preferred option.

The deal is expected to be announced within a fortnight, although negotiations between Sir Jim’s team and the Glazers are ongoing, meaning that the timetable for an announcement remains subject to change.

One source close to the talks said the additional $300m investment would be focused on United’s physical infrastructure, and not on addressing deficiencies on the playing side of the club.

The men’s first team has been plunged into crisis after successive 3-0 home defeats in the Premier League by Manchester City, and then by Newcastle United in the Carabao Cup.

Manager Erik Ten Hag is facing intense pressure to turn United’s season around, with a Premier League visit to Fulham this weekend followed by a crucial Champions League game at FC Copenhagen next Wednesday.

The incremental sum to be pledged by Sir Jim will address the concerns of observers who have questioned whether Manchester United will benefit from new investment in Old Trafford, which has fallen well behind the stadia of rivals such as Arsenal, Manchester City and Tottenham Hotspur.

However, United’s home is likely to need far more than £245m to deliver the overhaul required to turn it into one of the world’s elite football grounds again.

Sir Jim is understood to be committed to investing additional sums in future, although it was unclear on Friday whether these will be publicly discussed at the time of the stake purchase.

Several other key questions remain about United’s future ownership, including whether Sir Jim will ultimately seek overall control of the club.

Reports in recent weeks have suggested that he will take immediate control of football matters at the club, alongside Ineos Sports colleagues including Sir Dave Brailsford, the former cycling supremo.

Another area of uncertainty is the precise mechanism that Sir Jim will use to acquire 25% of both the publicly traded A-shares and the class of B-shares held by the six Glazer siblings, which carry the overwhelming majority of voting rights.

Analysts have suggested that it could be undertaken through a process known as a tender offer.

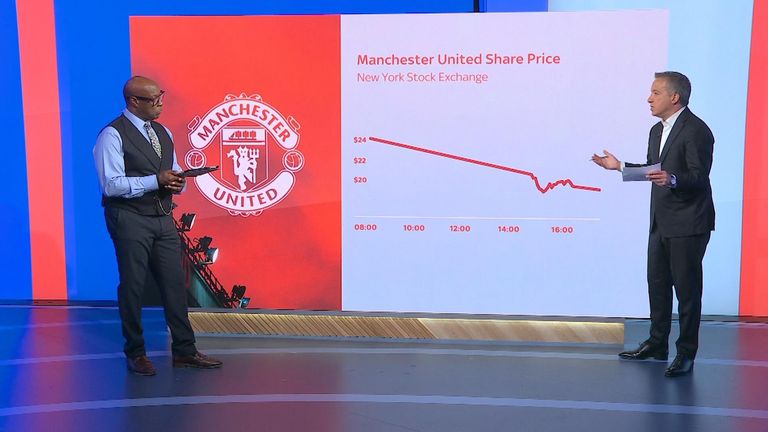

The price that Ineos Sports will offer has also yet to be disclosed, although it will be at a very substantial premium to the $17.92 at which they closed on the New York Stock Exchange on Thursday.

Some United fans have expressed disquiet at the prospect of Sir Jim buying a minority stake given that it paves the way for the Glazers’ continued control.

The family, who paid just under £800m to buy the club in 2005, has remained inscrutable throughout the process and has said nothing of substance to the NYSE since the process of engaging with prospective buyers kicked off last November.

Earlier iterations of Sir Jim’s offers for the club, which focused on gaining outright control, included put-and-call arrangements that would become exercisable three years after a takeover to enable him to buy out the remainder of the club’s shares.

The Monaco-based billionaire, who owns the Ligue 1 side Nice, pitched a restructured deal last month in an attempt to unblock the ongoing impasse over United’s future.

In addition to the competing bids from Sir Jim and Sheikh Jassim, the Glazers received several credible offers for minority stakes or financing to fund investment in the club.

These include an offer from the giant American financial investor Carlyle; Elliott Management, the American hedge fund which until recently owned AC Milan; Ares Management Corporation, a US-based alternative investment group; and Sixth Street, which recently bought a 25% stake in the long-term La Liga broadcasting rights to FC Barcelona.

These were designed to provide capital to overhaul United’s ageing physical infrastructure.

Part of the Glazers’ justification for attaching such a huge valuation to the club resides in the possibility of it gaining greater control in future of its lucrative broadcast rights, alongside a belief that arguably the world’s most famous sports brand can be commercially exploited more effectively.

United’s New York-listed shares have gyrated wildly in recent months as reports have suggested that either a deal is close or that the Glazers were about to formally cancel the sale process.

Earlier this year, Manchester United’s largest fans’ group, the Manchester United Supporters Trust, called for the conclusion of the auction “without further delay”.

The Glazers’ tenure has been dogged by controversy and protests, with the absence of a Premier League title since Sir Alex Ferguson’s retirement as manager in 2013 fuelling fans’ anger at the debt-fuelled nature of their takeover.

Fury at its proposed participation in the ill-fated European Super League project in 2021 crystallised supporters’ desire for new owners to replace the Glazers.

Confirming the launch of the strategic review last November, Avram and Joel Glazer said: “The strength of Manchester United rests on the passion and loyalty of our global community of 1.1bn fans and followers.

“We will evaluate all options to ensure that we best serve our fans and that Manchester United maximizes the significant growth opportunities available to the club today and in the future.”

The Glazers listed a minority stake in the company in New York in 2012.

“Love United, Hate Glazers” has become a familiar refrain during their tenure, with supporters critical of a perceived lack of investment in the club, even as the owners have reaped large dividends as a result of its ability to generate sizeable profits.

Ineos and Manchester United both declined to comment.