In the circumstances, the numbers could hardly look much better.

A year or two ago, the conventional wisdom was that America was facing a terrific recession.

Instead, according to the latest data from the International Monetary Fund, the US has outperformed pretty much every other major economy in the world (including China).

In its latest World Economic Outlook report – the most closely-watched set of international forecasts – it upgraded the US more than nearly every other major economy.

From a European perspective, there is much to be jealous of about America’s recent performance (most European nations, including the UK, saw the IMF downgrade their growth forecasts).

Yet here’s the puzzle. Despite this comparatively strong economy, despite having seen a lower peak in inflation than most European nations (especially the UK), American consumer confidence remains in the doldrums.

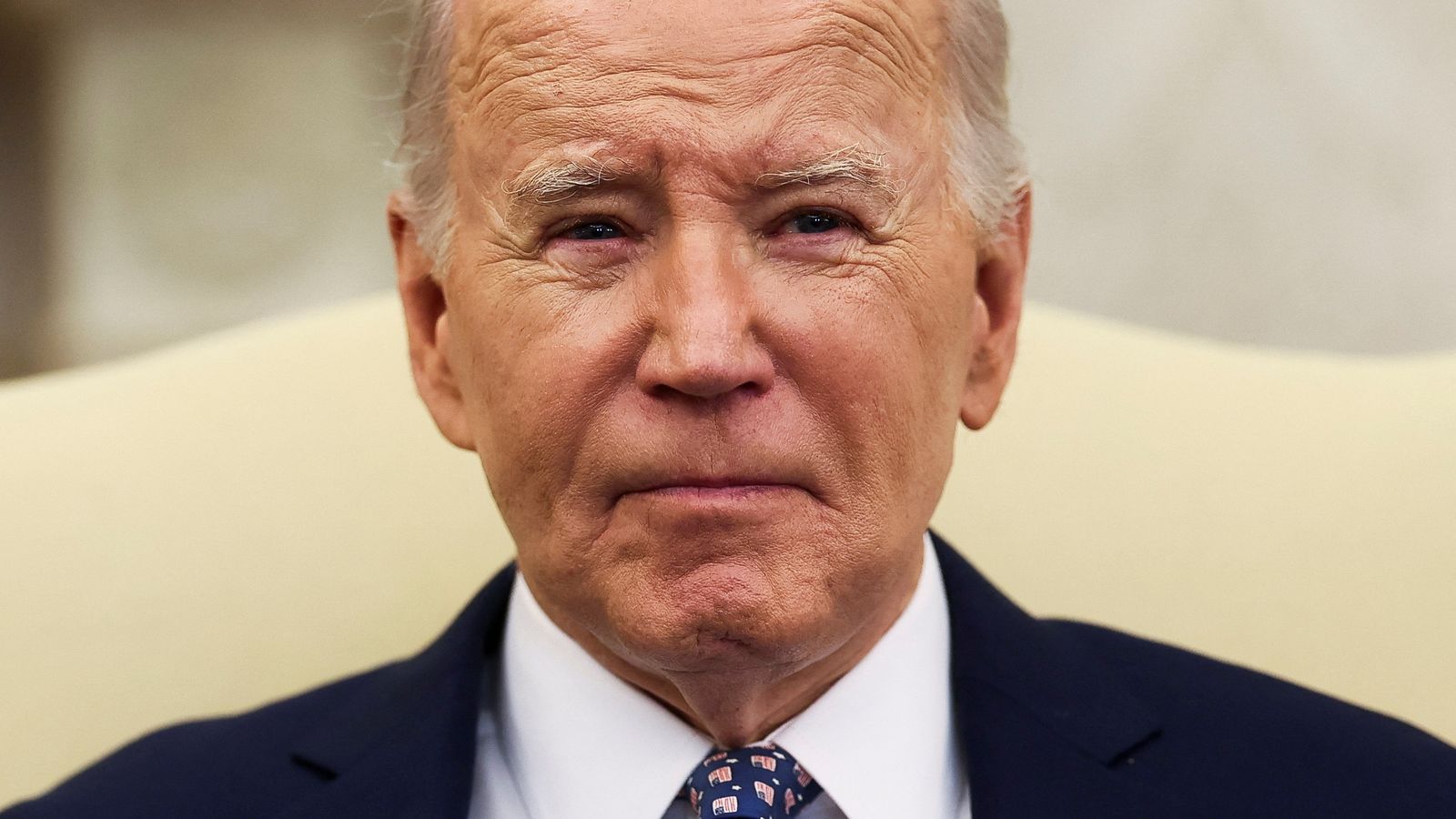

It’s not just Europeans who find this perplexing. So too does the White House.

They pumped cash into the manufacturing sector at the very moment it needed it, via a series of expensive programmes including the CHIPS Act (to bring semiconductor manufacturing back home) and the Inflation Reduction Act (to encourage green technology firms to set up factories in the US).

The idea was that from the depths of the pandemic, America would “build back better” – that Biden would emulate Franklin D Roosevelt and his New Deal of the 1930s.

And most conventional statistics suggest that strategy is bearing fruit. Manufacturing employment is rising; factories are being constructed at the fastest rate in modern history. And gross domestic product – the most comprehensive measure of output – is rising. Unlike in the UK or Germany, there was no recession.

So why, then, is consumer confidence so weak? Why are Biden’s approval ratings – the key polling benchmark for the US leader – lower than pretty much any of his predecessors at this stage in their terms?

Travel around Pennsylvania, as we have done over the past few days, and you encounter all sorts of explanations.

It’s the inflation, stupid

Food banks are getting busier; and while some businesses are beginning to see that federal money trickling down, many of the programmes are still at the approval stage. The money hasn’t arrived yet.

But, above all else, you hear one recurrent answer: it’s the cost of living. It’s food prices, it’s gas prices, it’s rents.

And there’s also a big gap here between life through an economic prism and the life lived on Main Street in places like Bethlehem PA – an old steel town trying to reinvigorate its economy.

Talk to an economist and they’ll remind you that inflation – the rate at which prices are changing over the past year – is finally beginning to drop. But while this is statistically true, it misses a couple of pragmatic realities.

First, prices aren’t going down; they’re just rising a bit less quickly than they were before. The squeeze hasn’t gone away.

Second, while economists often fixate on the change in the consumer price index over the past year (3.5% in March), what the rest of the population notices is the change in prices over a longer period.

Over the past two years prices are up around 9%. Over three years, they’re up 18%.

In other words, the explanation for the “vibecesssion”, as economists have christened it (there’s no formal recession but the vibes feel bad), might actually be exceptionally simple: It’s the inflation, stupid.

In Pennsylvania, perhaps the most critical of all the swing states in the US, the question is whether Donald Trump can capitalise on this disaffection to win over the citizens who abandoned him last time around.

In the meantime, the Biden White House is biding its time, hoping that those New Deal economic textbooks they followed when pumping cash into the economy are really to be trusted.