The fast-fashion giant Shein has held talks with the London Stock Exchange about the possibility of staging a blockbuster public listing in the UK, even after filing documents paving the way for a flotation in New York.

Sky News has learnt Donald Tang, Shein’s executive chairman, met executives from the LSE and other stakeholders in the UK economy during a visit to London last week.

City sources said the discussions were focused on the possibility of a listing in the UK, with one saying the Singapore-based behemoth was continuing to explore various options for raising capital through a public share sale.

A US listing remains the likeliest outcome for Shein, according to bankers and people close to the company, while a dual listing in both financial centres is said to be unlikely.

Its confidential filing with the US Securities and Exchange Commission, first-reported last month by the Wall Street Journal, suggested if it proceeded, a New York float would be among the largest in the last decade.

Goldman Sachs, JP Morgan and Morgan Stanley have been appointed to work on the deal.

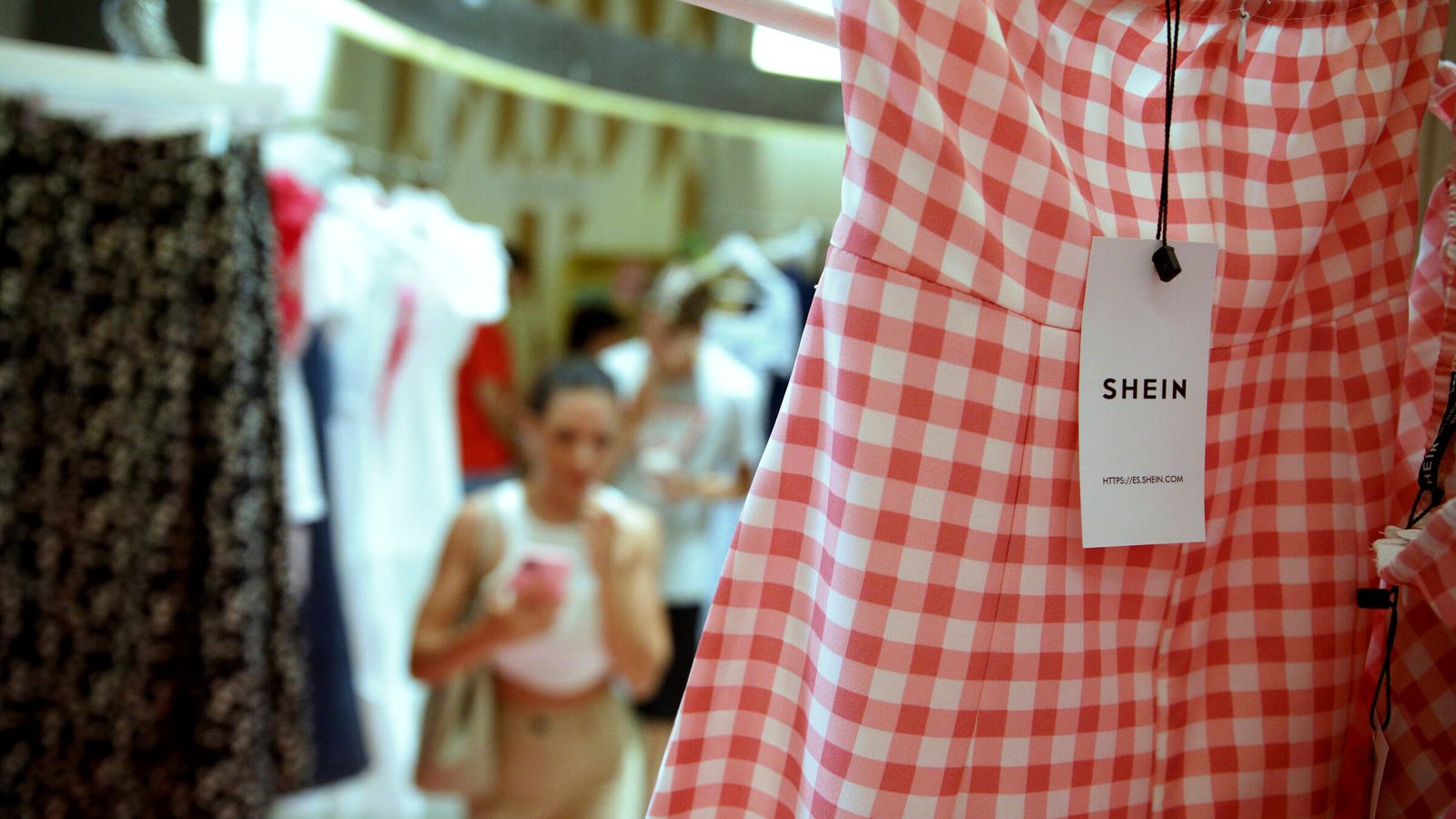

Founded in China in 2012, Shein has rapidly become one of the world’s biggest online clothing retailers.

It was valued at over $100bn last year, at which point it was worth more than H&M and Zara’s parent company, Inditex, combined.

The company’s valuation was slashed to $66bn as part of a share sale earlier this year.

Shein’s presence in Britain has grown in recent months after it struck a deal – revealed by Sky News – to acquire Missguided, the youth fashion brand, from Mike Ashley’s Frasers Group.

While the transaction itself was worth only a modest sum, retail analysts said it could pave the way for Shein to build a more meaningful profile in the UK, potentially through a broader collaboration with Frasers.

Shein now operates in more than 150 countries.

Earlier this year, Shein struck a deal with SPARC Group, a joint venture between the Ted Baker-owner ABG and Simon Property Group, a US shopping mall operator.

Under that deal, SPARC’s Forever 21 fashion brand gained distribution on the Shein platform, which boasts 150 million users globally.

Read more business news:

Broadcaster GB News in talks to raise £30m from investors

Shein acquired a one-third stake in SPARC Group, while SPARC Group also took an undisclosed minority interest in Shein.

The LSE’s efforts to court Shein come during a period of crisis for the City as a listing venue for large multinationals.

ARM Holdings, the UK-based chip designer, opted to float in New York rather than London.

Its decision was echoed last week by Marex Group, the commodities broker which had previously tried to list in the UK.

Other companies, such as the gambling operator Flutter Entertainment, have decided to shift their primary listings to the US, citing higher valuations and more liquid markets.

Shein declined to comment on Monday, while LSE did not respond to a request for comment.