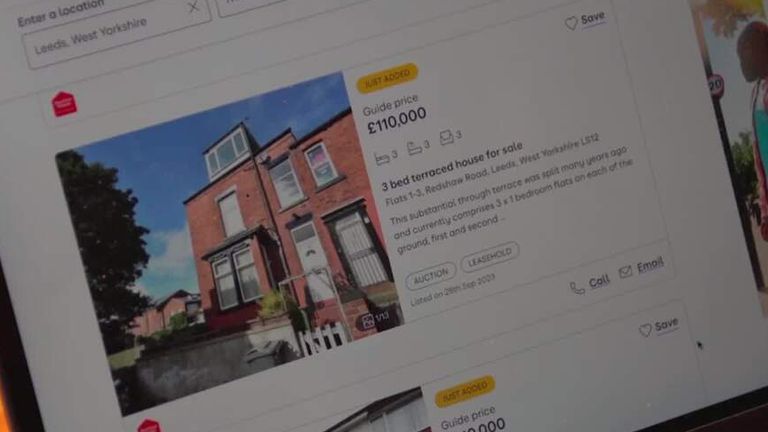

After six months of falls house prices across the country are on the rise again, according to analysis from part of the UK’s biggest mortgage lender.

Last month, for the first time since March, the cost of buying a house increased as the number of properties on the market shrunk, according to the Halifax house price index.

Despite a rise of 1.1% in October, following a 0.3% fall in September, prices are still lower than a year ago.

The increases meant the average house was sold for roughly £3,000 more than the month before at £281,974 compared to £291,248 in the same month last year.

Halifax is owned by the Lloyds Banking Group, the UK’s largest mortgage provider.

The steepest falls came in the southeast of the UK where prices declined 6% over the year to an average of £374,066.

Tuesday’s data echoes the finding of the Nationwide house price index published last week, which also showed a surprise rise in selling figures.

Read more on Sky News:

Homes numbered 13 are unlucky for sellers, analysts say

Zoopla says number of UK property sales on track to fall

It comes as mortgage rates have fallen from the highs seen over the summer as markets settle into the expectation that interest rates have peaked.

Meanwhile, the main measure of inflation – the consumer price index – stood at 6.7% in September, down from a recent high of 11% a year ago.

Contributing to the rise is a shortage of properties on the market, as sellers are cautious about listing a home, said the director at Halifax Mortgages, Kim Kinnaird.

This will grow prices in the short term but is not a sign of high buyer demand, she added.

“While many people will have seen their income grow through wage rises, higher interest rates and wider affordability pressures continue to be challenges for buyers.”

Drops in house prices are forecast, with growth not expected to return until 2025.

During the pandemic, house prices soared as savings rose and demand grew in more rural areas.

“On average, prices remain around £40,000 above pre-pandemic levels”, Kinnaird said.